What Is The Cme

2022年10月20日

Contents:

The NYMEX started when a group of butter and cheese farmers formed the Butter and Cheese Exchange of New York in 1872. UpToDate is recognized as a provider of e-learning under EBAH’s accreditation criteria. Credit points may be redeemed for up to 5 years from the time they were accrued.

Energy https://forexarena.net/ provide exposure to the price of common energy products used by companies (for manufacturing, production, and/or transportation) and by governments and individuals for consumption purposes. Index contracts and interest rate contracts are two types of financial futures. Index contracts provide exposure to specific market index values, while interest rate contracts are used for exposure to the interest rate of a specific debt instrument. Establishing an equity position in a margin account requires you to pay 50% or more of its full value. With futures, the required initial margin amount is typically set between 3-10% of the underlying contract value.

And today, we’ll talk about the largest futures exchange in the United States and the second-largest in the world. Operating virtually around the clock, today the CME Globex Trading System is at the heart of CME. Use of UpToDate may be claimed towards continuing professional development on the basis of 0.5 CPD credit for each point of care learning cycle completed including a reflective record.

The commodities available to trade on this exchange center on currencies, interest rates, stock indices, equities, and a few agricultural products. In its early days investors knew the exchange as the Chicago Butter and Egg Board all the way till 1919. CME proved to be the first financial exchange in the U.S. to demutualize so that it could become a company owned by stockholders in November of 2000.

Many types of futures to trade

In 1994, the New York Mercantile Exchange and the Commodities Exchange Inc. merged under the NYMEX name. The trading floor was not large enough to accommodate the huge number of the combined exchange’s employees, so it relocated to the World Financial Complex in southwest Manhattan in 1997. The potato bust tarnished the reputation of the NYMEX and trading volume declined significantly. The NYMEX President, Richard Leone, brought in John Treat, a White House energy advisor, to help restore the credibility of the exchange. He also sought to secure permission to offer trading in energy futures.

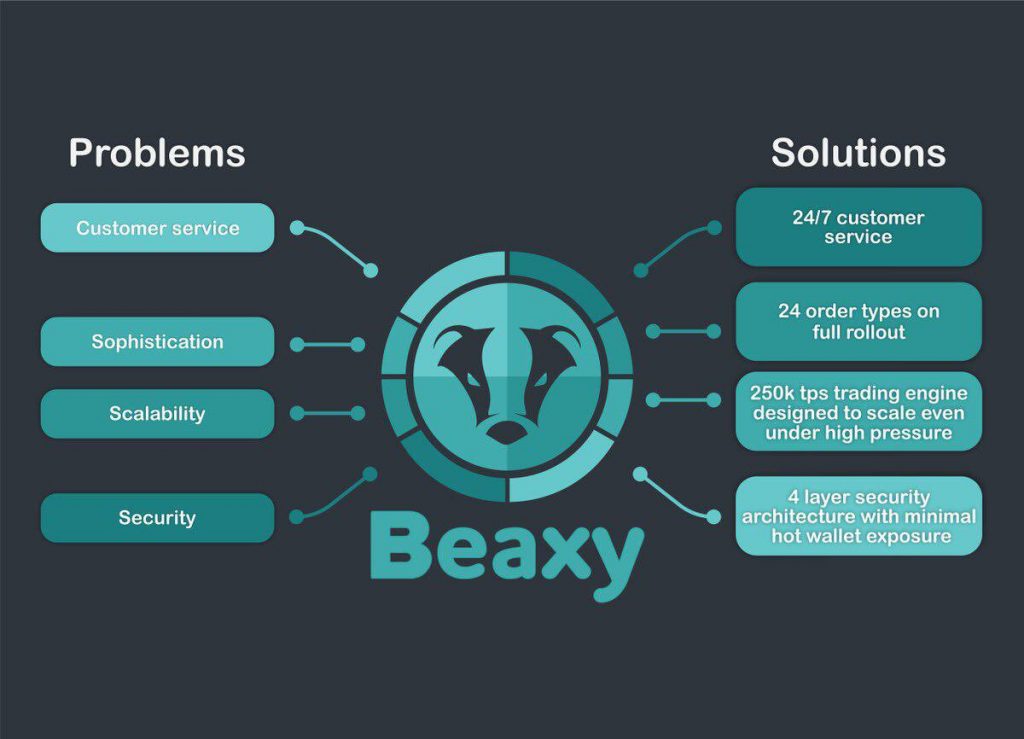

A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. While these commercial entities use futures for hedging, speculators often take the other side of the trade hoping to profit from changes in the price of the underlying commodity. A large family of futures exchanges such as the CME Group provides a regulated, liquid, centralized forum to carry out such business. Also, the CME Group provides settlement, clearing, and reporting functions that allow for a smooth trading venue.

Company Profile CME

When physicians participate in continuing education activities that are not directly related to their professional work, these do not fall within the ACCME definition of CME content. CME Group Definition – The CME Group is the world’s largest futures exchange, which includes the Chicago Mercantile Exchange , Chicago Board of Trade , and New York Mercantile Exchange . CME Group was created July 12, 2007 from the merger between the CME and the CBOT. On March 17, 2008, it announced its acquisition of NYMEX Holdings, Inc., parent company of the New York Mercantile Exchange, which was formally completed on August 22, 2008. On February 10, 2010, CME announced its purchase to buy 90% of the Dow Jones’s Indexes including the DJIA.

- But electronic trading has now largely replaced the ‘open outcry’ system.

- In 2006, the CME and the CBOT combined in a move that was approved by both organizations’ shareholders.

- The American College of Obstetricians and Gynecologists has assigned up to 0.50 cognate credit per Internet point-of-care learning cycle.

Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap names are the remaining 10% of companies. You can filter the list of activities by fields such as specialty, CME provider (for example, professional membership organization and/or affiliation), activity type, credit type, fee and location. ABIM’s collaboration with the Accreditation Council for Continuing Medical Education provides the opportunity for ABIM Board Certified physicians to earn MOC points for thousands of accredited CME activities. ABIM’s MOC program was created with input from thousands of physicians across the country.

Electronic trading

You can access this form from the Member Resources section of your RNZCGP Dashboard. Continuing Medical Education activities are certified for AMA PRA Category 1 Credit™ by an accredited provider. Some CME providers use web services to transmit completion information from their software applications or learning management systems, often resulting in MOC points being awarded within 24 hours of activity completion. During the day, NYMEX and COMEX utilize a system of open outcry on the floor. After regular trading hours, all trading is done on an electronic trading system.

Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. Futures and futures options trading involves substantial risk and is not suitable for all investors.

In 1969, it added financial futures and currency contracts followed by the first interest rate, bond, and futures contracts in 1972. Founded in 1898, the Chicago Mercantile Exchange began life as the “Chicago Butter and Egg Board” before changing its name in 1919. It was the first financial exchange to “demutualize” and become a publicly traded, shareholder-owned corporation in 2000. In 2007, the CME merged with the Chicago Board of Trade to create CME Group, one of the world’s largest financial exchange operators.

CME CME Group operates the world’s second largest futures and options exchange, the… Open outcry system A traditional way of communicating information across the trading floor of a stock ,… The Chicago Board of Trade is a commodity exchange established in 1848 where both agricultural and financial contracts are traded. Evidence of lifelong learning is shown by the completion of ninety hours of urology-focused CME credits, 30 hours of which must be Category 1 as defined by the AUA, twice during the 10-year MOC cycle. The credits are required at Level 2 and Level 4 of MOC and must take place in the three years prior to each deadline. The AUA reviews all activities requesting CME credits and assesses which portions of the program are eligible for credit.

Open an account today

You can also check to see if the CME provider has submitted your completion information by signing in to yourPhysician Portaland going to My Activities. Some CME providers require the diplomate to initiate or authorize the submission of MOC points in some way prior to sending your completion information to ABIM. Contact the CME providerto inquire about how to claim MOC points for a specific activity. Stock prices are delayed, the delay can range from a few minutes to several hours. The CME reports listing closing prices and trading activity are available daily for cheese, butter, and nonfat dry milk.

The chairman and chief executive officer of CME Group is Terrence A. Duffy, Bryan Durkin is president. On August 18, 2008, shareholders approved a merger with the New York Mercantile Exchange and COMEX. After the merger, the value of the CME quadrupled in a two-year span, with a market cap of over $25 billion.

- By the late 19th century, there were more than 1,600 commodity marketplaces.

- CME also pioneered the CME SPAN software that is used around the world as the official performance bond mechanism of 50 registered exchanges, clearing organizations, service bureaus, and regulatory agencies throughout the world.

- Certificates generated by UpToDate are fully recognized by CMIM and may in turn be submitted to Consejo Mexicano de Medicina Interna, A.C.

- For every hour spent in a CME activity, learners receive 1 hour of CME credit, known as AMA PRA Category 1 Credit™.

Chicago Mercantile Exchange received the honors of Exchange of the Year and Risk Awards Winner for 2016. Buyers and sellers can strike deals via the CME Globex electronic trading platform, which was introduced to complement the traditional open outcry system. Founded in 1898, the CME was originally called the Chicago Butter and Egg Board because it only traded contracts in butter and eggs. It later expanded its product line to frozen pork belly and foreign currency futures.

For many decades the exchange functioned solely as an open auction market. Traders would get together in a trading pit and utilize hand signals to buy and sell. Now the CBOT also offers futures contracts that are electronically traded.

They seek to profit by expressing their opinion about where the market may be headed for a certain commodity, index, or financial product. Some investors also use futures as a hedge, typically to help offset future market moves in a particular commodity that might otherwise impact their portfolio or business. Credit may be claimed, commensurate with participation, for partaking in other medical educational experiences and activities, such as independent exam preparation and informal self-learning activities. These activities may or may not be documented, and are not certified by the AAFP, AMA, AOA, but are of a nature of professional enrichment to the family physician. ABIM MOC registration is open to all CME providers accredited within the ACCME system, however it is voluntary. The CME providers determine which of their activities meet ABIM’s requirements in support of physician engagement in lifelong learning and quality improvement.

This information is shared among members of each board or committee, enabling open discussion about the nature of the work involved and any possible influence on the work of ABIM. NYMEX is the largest futures exchange for physical commodities in the world. The trading done here occurs through the two divisions of NYMEX and COMEX. On NYMEX, traders can participate with platinum, palladium, and energy markets. In COMEX they are able to trade precious and industrial metals such as silver, gold, and copper.

However, https://trading-market.org/ that haveAMA PRA Category 1 Credit™and AOA-approved activities are automatically accepted as AAFP Electivecredit. When a CME activity has AOA credit, it has been approved for credit by the AOA and may not have been reviewed for AAFP Prescribed credit. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

Riding The Market’s Ups And Downs With CME Group’s Exceptional … – Seeking Alpha

Riding The Market’s Ups And Downs With CME Group’s Exceptional ….

Posted: Thu, 09 Feb 2023 08:00:00 GMT [source]

With the construction of centralized warehouses in the main https://forexaggregator.com/ centers in Chicago and New York, smaller exchanges in other cities began to disappear while large exchanges like the NYMEX got more business. COMEX, the second division of NYMEX, was established in 1933 after four small exchanges merged. The exchanges included the Rubber Exchange of New York, the National Metal Exchange, the National Raw Silk Exchange, and the New York Hide Exchange. The Singapore Medical Council recognizes UpToDate as a Category 3A online provider. Doctors may submit CME credit claims for up to 10 CME points per 2-year qualifying period for their participation in UpToDate toward Renewal of Practising Certificates. Use of UpToDate may be recorded on the basis of 0.5 credits per activity in Section 2 of the Royal College’s MOC Program.